I don't mean to sound alarmist with the title, but if there's one thing I think more Americans could benefit from understanding at a basic level, it's the national debt.

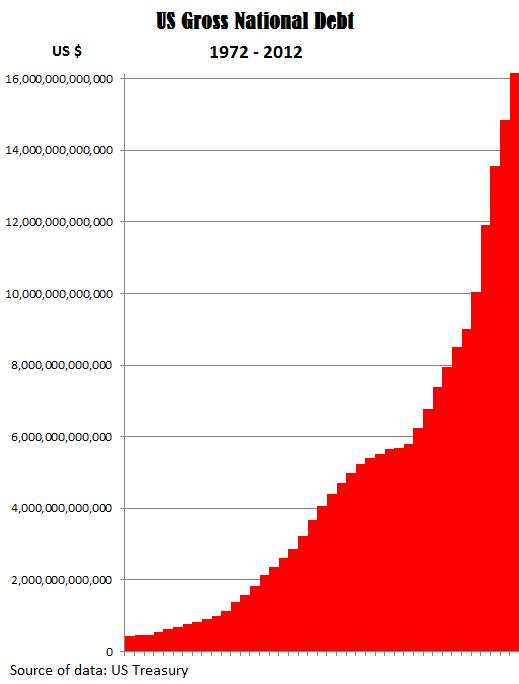

With the exception of the surpluses generated under the Clinton administration which began to smooth things out towards a logarithmic curve, we can see that the overall trend is one of exponential growth. Exponential growth is very bad as it goes through the roof and into outer space very quickly if we continue at this rate.

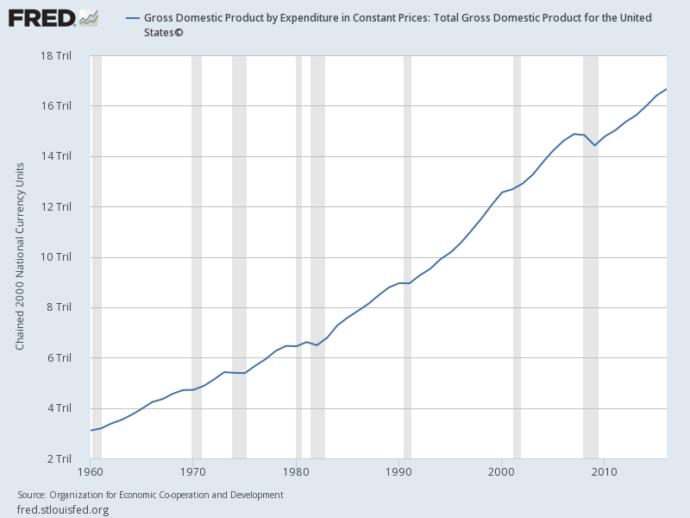

Meanwhile if we look at economic growth in terms of total domestic product over the recent decades, the trend is linear.

What happens when we have an economy that is growing linearly with a national debt that is skyrocketing exponentially? We're looking at an economic disaster unless something starts to change real soon.

The Cure

The cure is unfortunately painful. It's going to require politicians doing things that go against the interests of the vast majority of Americans.

They're most likely going to have to make huge cuts and/or raise taxes. Raising taxes is very unpopular and can also have the side effect of slowing down economic growth which means that we don't necessarily always see more tax revenue by raising taxes.

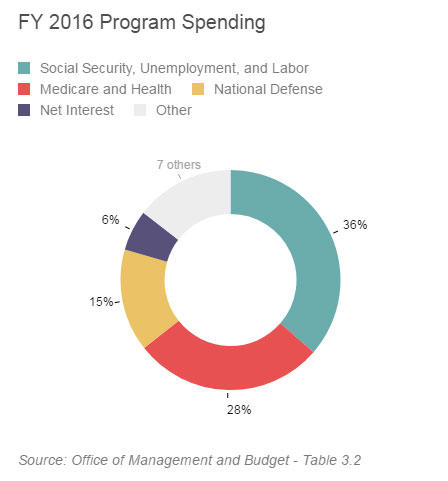

If they make cuts, they especially need cuts in areas that cost the most. These most costly areas would include social security, unemployment benefits, medicare, and medicaid. That covers about 77% of the entire tax revenue, and sometimes such cuts can also hinder economic growth.

These areas combined cost a total of around $2.3 trillion in 2016. That's out of the total tax revenue of only ~$3 trillion.

A common misconception I see Americans have is that national defense expenditure accounts for most of the budget. That's far from true. It's only relatively large as far as discretionary spending goes. The real bulk of the budget goes towards mandatory spending on services like social security and medicare.

Meanwhile the total spending in 2016 was over $3.5 trillion even though the tax revenue was slightly less than $3 trillion. That meant the US had deficit spending of over half a trillion dollars which it had to spend through borrowed money. The national debt, therefore, grew by yet another half a trillion dollars.

Drastic Cuts

If cuts are made, they're going to have to be quite drastic for practical purposes. Entire programs may need to be dismantled, and rather soon.

The reason for this is partly due to the nature of short presidential terms in the US with the possibility of a re-election. If a president can manage to negotiate huge cuts with Congress, he or she is inevitably going to become incredibly unpopular with many of the citizens. It's not like subsequent presidents have a track record of carrying over the policies of their predecessors.

It takes a very rare type of politician to put the long-term interests of the nation above that of its short-sighted citizens, and he or she is only likely to serve for four years before getting replaced by another politician who will just run deficit after deficit again in favor of popular appeal while destroying the nation's future.

As a result, such a politician willing to make huge cuts will likely have to dismantle entire programs and do so as quickly as possible to prevent his/her successors from undoing all that careful and unpopular work to reduce spending and/or increase tax revenue.

Interest and Insolvency

Currently interest for the national debt amounts to around ~$400 billion a year or $0.4 trillion a year. That's quite a huge chunk when the government is only taking in ~$3 trillion a year in tax revenue. That's actually almost as large as the entire expenditure on national defense.

That's ~$400 billion a year spent in a way that doesn't provide the tax payer anything. It doesn't provide roads, education, healthcare, military, law enforcement -- nothing at all. It's just money going towards interest payments.

While the debt is mostly held domestically with very low interest rates, the interest is generally going to rise proportionally as the government gets deeper and deeper into debt. At some point and in the not-so-distant future if the debt continues to rise exponentially, the cost of interest alone will exceed tax revenue.

At that point the government has reached a state of insolvency. It cannot possibly ever hope to pay back its debt, and it will have to default on its debt. When that happens, we are looking at a global economic collapse. It won't just affect the United States but the entire world which trades with the United States.

All government services will suddenly be discontinued. There will be no army, no law enforcement, hospitals might shut down, medicare/medicaid will suddenly be discontinued, social security pensions will be discontinued all at once, public schools will shut down. Workers will probably be on strike. It's not a good situation for the US let alone the entire world.

Keynesian Economics

As a brief note, Keynesian economists suggest that increasing government expenditure with fiscal stimulus when the economy is in a recession can help bolster output in the short term. The whole idea is to superficially stimulate aggregate demand.

Unfortunately even if this can work, it's not exactly something that the government can afford to do when it's facing massive debt. It's also extremely risky when we have a track record of a government that constantly lacks the discipline to reduce spending soon after.

We can't necessarily even afford to risk applying Keynesian economic policies when looking at such enormous debt. It's tempting to get excited when politicians talk about stimulating the economy, but it's very risky and we should be very cautious when the national debt is rising out of control.

Conclusion

I hope this will lead some Americans to investigate this issue further. It's important to understand because the United States is at a point now where politicians have to do unpopular things and have to make big cuts if the nation is going to avoid a total economic meltdown.

Those who are proposing big cuts are not doing this to screw ordinary citizens over. They're unfortunately damned either way. If they make the unpopular cuts, they are going to help save the nation's future but will be considered by many as horrible people. If they don't make the unpopular cuts, they are damning the entire nation to keep the masses happy.

There's an entire nation at stake here and it worries me because a lot of people seem to want the government to provide more and more services, which generally means more and more government spending. That's a suicidal path when the nation is already this deep in debt.

Here is a national debt clock that's worth looking at from time to time:

https://www.usdebtclock.org/

Finally, this problem isn't unique to the United States. We're facing a similar crisis here in Japan. If Japan can't start generating surpluses and avoid deficit spending in the near future, we're screwed.

Japan is worse off than the US to the point where some economists have already concluded that it has reached a practical state of insolvency. The US isn't quite there yet, but with a trend towards exponential growth in national debt, the nation could find itself in the exact same state very soon.

For further understanding of this issue, it's worth looking into the Federal Reserve which controls the money supply and is the largest holder of the US national debt.

Most Helpful Opinions