Bitcoin offers a better solution as a store of value in comparison to gold. When we look at a store of value, we must consider what attributes towards what we’re seeking. We can break it down into three points. We’ll be looking at scarcity, performance, and property rights. Bitcoin surpasses gold in all three points in a multitude of ways. Bitcoin offers the properties of gold in a more efficient way, plus it adds a lot of other beneficial properties that one would seek in an investment. Bitcoin is specifically designed to hold value, and it’s being adopted on a massive global scale. Currently, it’s competing with gold and all other assets. It’s an apex predator of an asset in today’s financial markets.

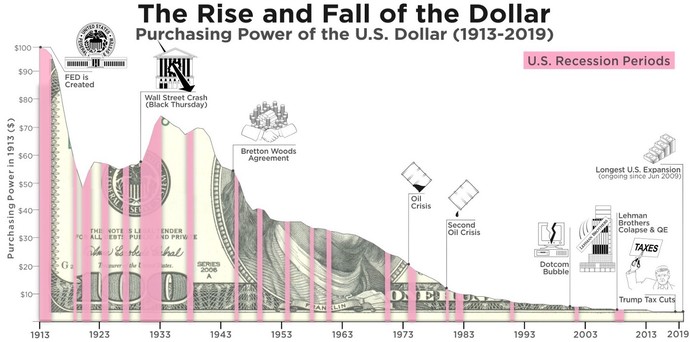

What is scarcity? Scarcity is a scenario in which demand for a good or service is greater than the availability of that good or service. The properties of gold operate in a way that holds value. The purpose is to store your capital where inflation does not erode its value. Similarly, Bitcoin operates in the same way. When we consider these properties in an asset class, we must understand that holding onto dollars is the equivalent of holding onto a melting ice cube. The Keynesian economic structure we live in creates inflation. When fiscal and monetary policymakers create more dollars in circulation, those dollars become less valuable over time. We hedge against this economic force known as inflation by investing in assets that possess scarcity. In other words, we want to look for assets that have what’s known as an inelastic supply. Gold serves to meet this criterion, because there is a limited amount of raw material available, regardless of what the market demands. Likewise, Bitcoin serves to meet this criterion because it has what’s known as a finite supply. There can only be twenty-one million Bitcoin mined into existence. For that reason, it becomes extremely scarce. There can always be a large investment in gold mining, which results in the supply of gold increasing, but there can never be any more Bitcoin. If the federal reserve continues quantitative easing, then more dollars are created into circulation. If there’s scarcity, then this creates a situation in which Bitcoin’s secular trend only goes up. The more money printing, the more Bitcoin and gold purchased, therefore the higher value.

Ultimately, when we put our money into an asset class, we want to end up with more money than what we started with. The more money we get in return, the better it performed. When we analyze performance, it’s difficult to deny that bitcoin surpasses gold in any facet. Over the last decade, Bitcoin has outperformed all other assets by a factor of ten. According to the chart today, Bitcoins return since the March 2020 Covid Crash has been 1,188%. Gold in the same time frame has returned 28%. According to several measurements of inflation readings such as the PPI, and CPI, gold has barely kept up. The beauty of Bitcoin is that you have scarcity put in its design, plus we have the growth factor that we commonly see in adoption curves regarding disruptive technologies. In laments terms, you have the get the best of both worlds when you purchase and hold Bitcoin. With gold, you only get the scarcity factor in your return on investment. Having said that, gold offers less volatility than Bitcoin, but the more Bitcoin grows, the more stable it becomes. The risk to reward ratio makes investors and fund managers salivate.

When we discuss commodities such as gold and Bitcoin, property rights are a vital point of discussion. Property rights are the theoretical and legal ownership of resources. When we live in an economic structure that has a risk of becoming insolvent as an entirety, property rights become of high importance. When you purchase shares of a security on Robinhood or other well-known exchanges, you simply purchase a note that says you own the rights to that share. The exchanges might not even hold that share at a 1:1 ratio before it settles which can take days. The third parties involved can at any time put a hold on your account and essentially lock up your money. What makes gold and Bitcoin unique is that there is no need to have any middleman. You can fully own it with nobody else’s hand in it. With gold, you can purchase physical gold, and store it away. Likewise, with Bitcoin, you digitally store it away and keep it offline. When you store your Bitcoin into what’s known as a hard wallet, your Bitcoin is offline. Nobody can access it. You essentially are your bank which of course comes with its own sets of responsibilities. Some people enjoy being their own bank, and others rather put that responsibility on someone else. A large portion of the gold market cap and liquidity is held in exchange-traded funds and trusts that you can digitally purchase on an exchange. In this scenario, it’s the same as purchasing a security on an exchange as I mentioned above. You have third-party risks. You only own a note saying that this exchange owes you this amount of gold. It's an antiquated process to purchase physical gold and store it in my opinion. You must research the company, test the gold to see its purity when you get it, and store it in a locked safe. It's difficult to liquidate gold and borrow against it, and it’s certainly difficult to transport it. With Bitcoin, I simply remember my seed phrase, and I can access my entire net worth anywhere I go. I can also borrow against it to purchase more assets with ease.

Overall, I am a strong advocate for Bitcoin. I own gold and have invested in gold for the last ten years. Having said that, it comes with its shortcomings. Due to market manipulation and an exodus into Bitcoins market cap, its performance has been quite disappointing. Bitcoin is what I like to look at as digital energy. Money is scarce monetary energy that serves the utility of purchasing goods and services to sustain life. Bitcoin offers this utility with many others in a digital format. It has an exponential growth curve to consider, and it does everything gold does, but better. Nobody has sole proprietorship of the Bitcoin network, and therefore no central entity can manipulate the supply. This is a sovereign asset that truly gives the power back to the people rather than the few who decide the fate of our monetary power in society. Bitcoin is neither Republican or Democrat, good nor evil. Bitcoin is neutral, and it gives opportunities to those who currently work in our financial system and everyday people who simply want to sustain a good life for themselves and their families. Gold has served its purpose to fulfill these objectives as a store of value but is on the cusp of becoming obsolete in the presence of Bitcoin.

Holidays

Holidays  Girl's Behavior

Girl's Behavior  Guy's Behavior

Guy's Behavior  Flirting

Flirting  Dating

Dating  Relationships

Relationships  Fashion & Beauty

Fashion & Beauty  Health & Fitness

Health & Fitness  Marriage & Weddings

Marriage & Weddings  Shopping & Gifts

Shopping & Gifts  Technology & Internet

Technology & Internet  Break Up & Divorce

Break Up & Divorce  Education & Career

Education & Career  Entertainment & Arts

Entertainment & Arts  Family & Friends

Family & Friends  Food & Beverage

Food & Beverage  Hobbies & Leisure

Hobbies & Leisure  Other

Other  Religion & Spirituality

Religion & Spirituality  Society & Politics

Society & Politics  Sports

Sports  Travel

Travel  Trending & News

Trending & News

What Girls & Guys Said

Opinion

1Opinion

Hdhxjc

Share the first opinion in your gender

and earn 1 more Xper point!